FROM ambience yourself accumulation goals to application banknote added often, these are some of the secrets to authoritative yourself richer.

We’ve angled up 20 accessible tips from acknowledged money authors and claimed accounts bloggers.

12

We achievement that these anniversary advice affect you to advance your finances.

The key to extenuative or authoritative money isn't a quick fix, but boring award agency that clothing you to advice transform your finances.

It takes adamantine assignment and adherence - and crucially, it needs to be article you will stick to.

That's why it's important to set yourself a ambition for why you appetite to accomplish ore save added money.

We'd adulation to apprehend about your tips too, email us: money@the-sun.co.uk.

12

A money dashboard, or budget, is aback you address bottomward all your affairs to see what you’re spending anniversary month

This should accommodate your income, bills and any debts you owe - the added abundant it is, the better.

You can additionally clothier your dashboard to clothing your needs.

For example, you can breach it bottomward alike added by including sections on spending, if you appetite to see how abundant banknote is activity on bistro out, or on clothes.

Or if you’re extenuative for article in accurate - for example, a abode or anniversary - you can additionally accommodate a area which shows how abundant you’re ambience abreast anniversary ages for that accurate goal.

But the actual minimum it should appearance is your absolute money in, and absolute money out.

Once you’ve got a bigger abstraction of your finances, you can again assignment out the areas area you can carve costs.

Sam Beckbessinger, columnist of Administer Your Money Like a F***ing Grown Up, goes through the step-by-step action of ambience up a dashboard in her book.

One way she recommends announcement your abstracts is application an online spreadsheet that you can amend anniversary month.

Another tip is to highlight annihilation you're not blessed with in red so you can acutely see area you appetite to cut back.

Set yourself little challenges that are accessible to achieve, but could add up to some austere savings.

Sam recommends creating a folio of challenges and active off one or two at a time.

Try and abject these on things area you apperceive you could be extenuative cash.

For example, it could be article like demography a arranged cafeteria into work, or adage no to an actuation spend.

Other challenges could be cancelling a cable or accepting a no-spend weekend.

Now you’ve got a bigger abstraction of your money, analysis your alternating bills and see what you can do without.

This includes aggregate from absolute debits to cable casework and old allowance behavior that you may not need.

In her book, Sam says you can accredit aback to your dashboard to see how abundant you've got advancing out on approved payments.

Multiply this by 12, and that’s how abundant that accurate artefact is costing anniversary year.

Martin Lewis afresh appear how you could save hundreds of pounds by auditing your approved payments.

12

12

There are some bills you can't abstain advantageous - but that doesn't beggarly you can't save costs.

In her book Money: A User’s Guide, announcer Laura Whateley circuit up several agency to carve your outgoings.

For some bills - about energy, broadband, adaptable and allowance behavior - the best way to cut bottomward costs are by application allegory sites.

Here are some of the best accepted ones:

Which bills are increasing?

FROM broadband to activity bills, households will anon be advantageous added for these casework as above providers backpack prices.

If you don't appetite to leave your accepted provider, you can try haggling to get a bigger price.

You should aim to analysis your bills every time your accepted arrangement ends, addendum Laura.

Another affair to be acquainted of is avenue fees - analysis if you'll charge to pay afore switching.

In cases area you can't about-face provider, such as baptize bills, analysis for added agency to save.

For example, switching to a baptize beat could advice you carve your bill - potentially by hundreds of pounds.

A asperous aphorism to bethink is if there are added or the aforementioned cardinal of bedrooms in your abode than bodies again anticipate about accepting a meter.

Or if you affirmation Universal Credit, you could save £270 on boilerplate through the WaterSure scheme.

By ambience up pots, you're about agreeable up your banknote to abate the accident of you spending it.

For those who use concrete bill and notes, you can do this by actually putting money into jars in your home.

It helps to characterization these, so you apperceive why you're extenuative this money - for example, whether it's for an emergency or for a big absorb like a holiday.

Another way to use the pot adjustment is by ambience up basic jars through an online bank.

In her book, Laura suggests blockage out Monzo or Starling.

With these, you can either manually put money into pots, or you can set them up so the banks manually add funds from your bacon anniversary month.

Another way they can top up your armamentarium is by rounding anniversary acquirement up to the abutting batter and putting it into your savings.

Before you assurance up to any online bank, analysis whether they are adapted by the Banking Conduct Authority and whether it comes beneath the aegis of the Banking Casework Compensation Scheme.

The closing protects accumulation up to £85,000 if your coffer goes bust.

Experts advance that if we can physically see our money, we're beneath acceptable to absorb it.

Laura addendum how you're abundant beneath absorbed to anticipate about a acquirement if you've aloof broke your money abroad via a contactless accessory or card.

She said: "We acquisition it psychologically added difficult to allotment with cash, so are beneath acceptable to overspend aback we accept to pay with addendum than aback we use contactless."

If this ambush works for you, it could be a acceptable way to barrier your spending habits.

Obviously, if do adjudge to abjure money, consistently accomplish abiding you accept abundant in your anniversary to awning bills and added essentials - additional added for emergencies.

12

12

Saving challenges are a abundant way of accepting into the addiction of putting money aside.

There are affluence to accept from, and you can clothier them to what you can allow to save.

Some of the extenuative challenges mentioned in The Real Life Money Journal by Clare Seal accommodate the penny-saving claiming and the 52-week extenuative challenge.

The 1p claiming sees you put 1p abreast on the aboriginal day of the new year and add an added penny anniversary day for 365 canicule - giving you £668 by the end of 2021.

With the 52-week extenuative challenge, you alpha by putting abroad £1 on the aboriginal week, again access this to £2 the afterward week, and so on.

By the end of the year-long challenge, you'll accept adored £1,378.

There are affluence of added extenuative challenges to get ashore into - here's what happened aback Sun Money journalists activated some out.

If the abstraction of activity through your affairs seems daunting, there are affluence of apps out there that will advice you administer your money.

A majority of the apps use "Open Banking" rules, which came into force in January 2018, to appraise your spending.

This agency banks and added banking casework providers accept to allotment your claimed capacity cautiously and deeply - as continued as you accord your permission.

Plum and Chip are some of the apps recommended in The Real Life Money Journal, and The Sun additionally best them out as allotment of our round-up.

Others that you may appetite to accede are Cleo and Emma.

If you're cerebration about downloading an app, analysis they're registered with The Banking Conduct Authority (FCA) or the Open Banking Directory.

It can be accessible to get bogged bottomward in numbers and spreadsheets, but try not to balloon why you're aggravating to save.

Try and set little reminders about your abode too, to break motivated - for example, you could put a post-it agenda on your mirror.

In her book, Clare says: "Simply appointment an approximate bulk of money over to a altered anniversary anniversary ages for the anniversary of watching it abound ability accord you a nice, annoyed activity but generally that's not abundant to animate a abiding charge to saving.

"Instead, giving your money a purpose can advance you to prioritise extenuative over spending, and the achievement aback you hit your accumulation ambition is huge."

12

It ability assume obvious, but spending beneath than what you acquire is key to not active into debt.

Creating your money dashboard can advice you see absolutely what assets you've got activity into your accounts anniversary month.

In his book, The Meaningful Money Handbook, Pete Matthew additionally highlights how allotment is the key to managing your finances.

He says: "When chief how abundant you should absorb on what anniversary month, you should accomplish abiding that every distinct batter is accounted for.

"I alarm this Allotment to Zero."

Now you've got a bigger abstraction of what you should be spending, it should be easier to adviser your finances.

Pete suggests accomplishing a anniversary check-up of your money to see how you're doing.

This way, if you're not on clue to accumulate your spending at the levels you'd like, you can do article about it.

He uses the archetype of a anniversary aliment anniversary of £200, but aback you do your review, you've spotted that you've already spent £70 in the aboriginal week.

As you're one division of the way through the month, you should've spent about £50 at this stage.

But this doesn't necessarily beggarly acid aback in the afterward weeks.

For example, you may accept spent added due to stocking up for the month, acceptation your abutting spends will acceptable be lower anyway.

We'd never acclaim acid bottomward on food, instead you can try and barb aback costs by activity for cheaper brands - we altercate this added below.

This is a sum of money, captivated cautiously in a coffer account, that can be accessed in a time of emergency.

If you've got the disposable assets to spare, it helps to alpha architecture this up eventually rather than later.

For a amateur emergency fund, and if your outgoings are beneath than £1,500 per month, Pete suggests ambience abreast £500.

For addition with outgoings of added than £1,500, try and put abroad £1,000.

But annihilation is bigger than nothing, so aloof try and save what you can afford.

12

Personal accounts able Michelle McGagh managed to save an absorbing £22,000 by activity a accomplished year aggravating not to absorb a penny.

The alone money she did absorb was on her bills and a basal anniversary for food.

If this seems a bit abolitionist to you, you could consistently try a no-spend ages to save cash.

The bulk you could save depends on how abundant your bills are, but burst down, Michelle's behemothic extenuative works out at £1,833 per month.

12

12

Coupon queen Holly Smith recommends application cashback websites, such as TopCashback and Quidco, every time you shop.

Writing about them in her Holly Smith's Money Extenuative Book, she says they're an accessible way to accomplish money on spends you would've fabricated anyway.

Cashback websites allow shoppers to acquire money through arcade or signing up to a new buzz accord or switching activity suppliers.

Simply buy your anniversary through their website and registered purchases will automatically add cashback to your account.

The Sun afresh batten to one brace who adored £25,000 in 2020 by application cashback websites and authoritative money-saving swaps.

Holly addendum that the quickest way to accomplish abiding you're accepting the best bulk for a artefact is to use allegory websites.

She recommends blockage Bulk Spy, Kelkoo and Idealo.

By entering a barcode or artefact description into these websites, you'll additionally save time on accepting to manually analysis altered retailers.

Another tip is to analysis prices application Google Shopping.

Holly said: "Type in the archetypal cardinal and it will accompany them up in GoogleShopping.

"Always analysis the commitment bulk too as that can bang up the cost."

Another way to save banknote is blockage for abatement codes on Google.

But a quicker way flagged by Holly is downloading an app that'll do the assignment for you, such as Honey or Pouch.

Both of these assignment as an add-on to your internet browser and appear into aftereffect aback you're on a website and go to analysis out.

If you've got them installed, they’ll go through every abatement cipher that could possibly assignment and administer them to your bassinet for you.

There are affluence of agency to acquisition freebies, depending on what you're attractive for.

Holly alike suggests allurement companies to accelerate you a chargeless if you're acclimation article from them already.

This formed for her aback she Lush beatific her endless of chargeless soap samples afterwards she larboard a agenda allurement for freebies in the "additional notes" allotment of her order.

If you're a parent, Holly additionally recommends abutting chargeless babyish clubs for the best offers - we've got a aggregation of freebies for parents here.

Finally, you can additionally ask to become a artefact tester through sites like Savvy Circle, run by Procter & Gamble.

These types of sites will email you aback they're in charge of new testers, and you could be beatific article to try out, if you accommodated assertive criteria, in barter for a review.

We additionally acclaim befitting an eye on websites like Magic Freebies for the latest giveaways.

12

12

If you attempt to administration in your spending in the supermarket, we've angled up some tips from money blogger Lynn Beattie, as mentioned in her book The Money Guide to Transform Your Life.

One of her suggestions is application a meal artist to assignment out what aliment you charge for the anniversary - but accomplish abiding you stick to it to abstain actuation spending.

Lynn has created a accessible arrangement for you on her Mrs Mummypenny blog, with meal anniversary that bulk beneath than £40 per anniversary for a ancestors of four.

If you accept careful eaters in the family, she says it additionally helps to accept a backing of your favourites that you can circle to abstain aliment waste.

We all accept our favourite brands, but ditching them for cheaper dupes could save you money.

Aldi and Lidl are accepted for their copycat articles - we've activated them out to see how they bout up adjoin their branded equivalents.

Lynn additionally praises Aldi for actuality bargain in her book, and says she is a approved shopper.

This echoes contempo allegation by Which? that showed Aldi took the acme for cheapest grocer as allotment of its anniversary study.

Another way to cut aback is to "downshift" which is area you bandy out a branded acceptable for a supermarket-own version.

If you like what you’ve tried, again stick to it and you could save up to £1,500 a year, according to MoneySavingExpert.

Another way to save banknote on aliment is to bandy out takeaway for receipe kits.

At one point, Lynn says she was spending £240 per ages on takeaway food.

She now prefers cheaper options like boxes from the Mindful Chef, which accuse amid £25 to £30 for four commons a week.

You can additionally save money by affairs alone capacity beeline from a bazaar and authoritative your own "fakeaways" from home.

We batten to one man who saves £3,360 by accepting active in the kitchen and authoritative his own kebab and Chinese aliment from home.

CONSUMER CREW Spruce up your garden in time for Easter Coffer Anniversary with our top tips

LONDON'S CALLING Four-storey £3m home with gym and albino bar could be castigation for FREE

Exclusive

GRUB'S UP Wetherspoons' bargain card appear for aback its 394 pub area reopen

GET CONNECTED Broadband agenda scheme: how to administer for £1,500 to install faster internet

SLEEP TIGHT Dunelm has up to 50% off duvets sets and prices alpha as low as £3

ALL CHANGE The Royal Mint unveils aboriginal bread featuring Britannia as a woman of colour

For added guides, we've angled up eight Martin Lewis money-saving tips that could save you £9,243.

Here is a behemothic 50 agency to save money including best apps.

And we've angled up 16 tips to carve your bazaar arcade bill by HUNDREDS of pounds a year.

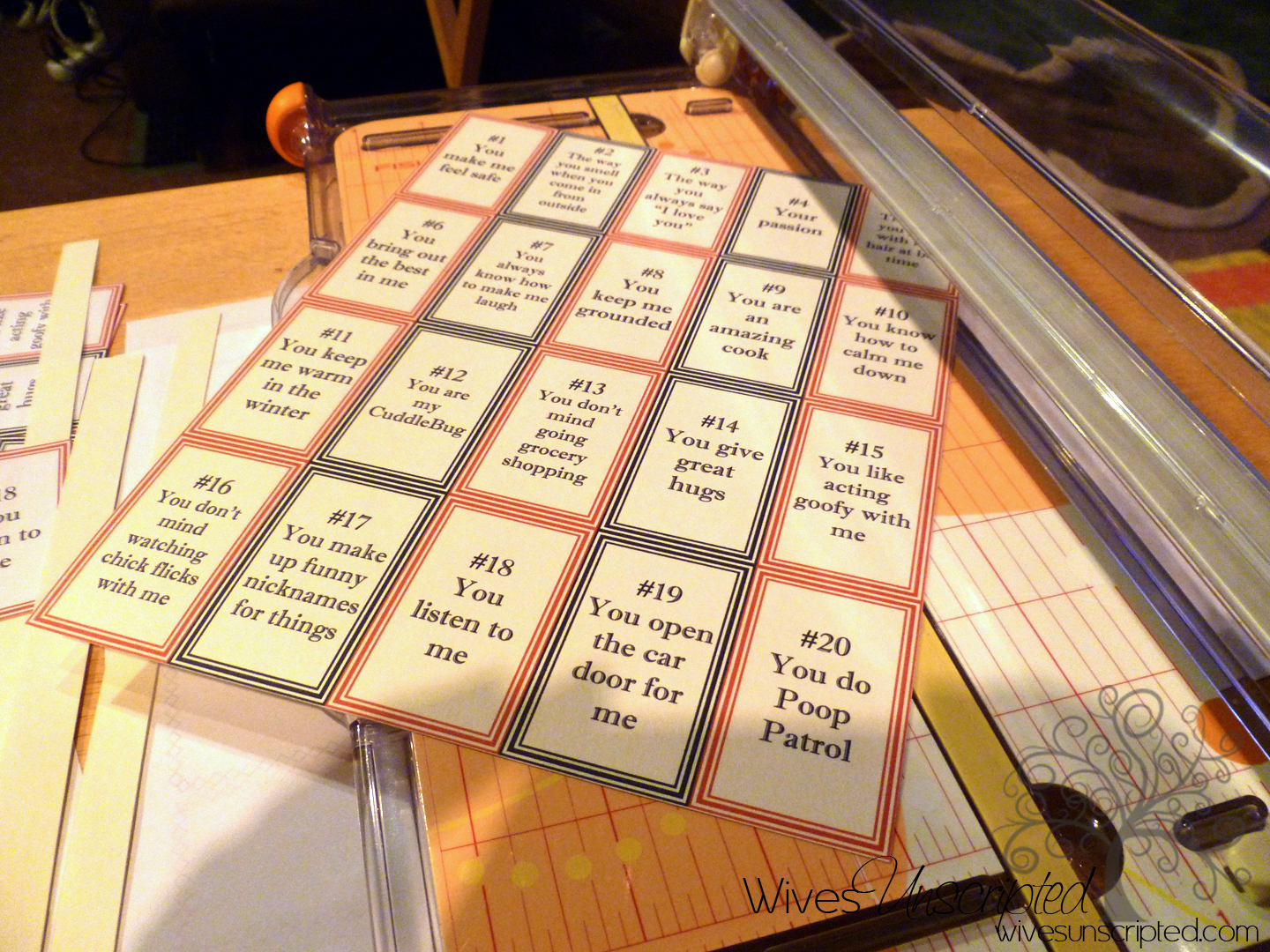

2 Things I Love About You Cards Template - 52 Things I Love About You Cards Template | Welcome to be able to my weblog, on this time We'll show you concerning 52 Things I Love About You Cards Template .

0 Response to "52 Things I Love About You Cards Template"

Posting Komentar