VIRGINIA CITY, Nev., March 11, 2021 (GLOBE NEWSWIRE) -- Comstock Mining Inc. (“Comstock” and the “Company”) (NYSE American: LODE), a adapted accustomed ability assembly and processing company, appear its abounding year 2020 after-effects and its affairs for affair the rapidly ascent appeal for accustomed assets and added deficient metals for apple-pie activity technologies.

Select Cardinal Highlights

Acquired majority pale rights in LiNiCo, a lithium-ion array recycling company;

Acquired an aberrant cardinal pale in Green Li-Ion, innovator of 99.9% authentic cathode recycling technology.

Launched Philippine-based mercury remediation and gold affirmation ("MCU-P") collective venture.

Launched MCU’s Nevada-based mercury remediation pilot and gold affirmation project.

Secured analysis charter with celebrated Sutro Tunnel Company, targeting gold and argent resources.

Acquired advantage to acquirement all properties, rights, and royalties associated with Sutro’s properties.

Completed abounding calibration geophysical surveys and antecedent interpretations for the absolute Comstock Lode District.

Executed agreements to advertise two non-mining backdrop in Argent Springs for $10.1 actor in 2021.

Executed a charter with the advantage to advertise the Daney Ranch acreage for $2.7 million.

Completed a abundance auction to Tonogold Resources, Inc., recording a accretion of $18.3 million.

Launched a three-year cardinal plan and accumbent 100% achievement incentives with the Company’s goal.

Raised $15 actor in net disinterestedness accretion in 2021, abolition all debt obligations and allotment new beforehand initiatives.

Select Banking Results

Net assets was $14.9 million, or $0.49 per accustomed share, due to an $18.3 actor accretion on Tonogold sale.

Debt obligations were $3.6 actor at December 31, 2020, all of which was abolished in 2021.

Cash and equivalents was $2.4 actor on December 31, 2020, and $12.1 actor on March 5, 2021.

On March 4, 2021, the Aggregation bankrupt on a $16 actor registered absolute auction of 4 actor accustomed shares at a amount of $4.00 per share. Net accretion were about $15 million, afterwards commissions and expenses. The Aggregation now has 42,455,515 accustomed shares outstanding, including the 4 actor registered shares awash in the March 2021 offering, and 3 actor belted shares issued as application to LiNiCo in affiliation with the LiNiCo allotment acquisition. On March 5, 2021, the Aggregation abolished all of its debt obligations accretion $3.6 million, extenuative over $0.3 actor in absorption amount over the abutting 6 months.

Story continues

“We accept auspiciously restructured our business over the accomplished three years by eliminating debt and badly abbreviation costs, while repositioning our assets to body stakeholder amount with transformative, aerial value, aerial impact, altitude acute mining and valorization projects, in ample allotment to accommodated rapidly ascent appeal for the added deficient metals and added raw abstracts bare to ammunition the all-around alteration to apple-pie energy,” declared Corrado DeGasperis, Executive Chairman and CEO. “Our aboriginal valorization activity launched in 2020 with the MCU all-around mercury remediation system. Our added valorization activity afresh closed, with our access into lithium-ion array recycling through our ample pale in LiNiCo, and we are alone aloof beginning, as we are currently evaluating several absolute exciting, strategically aligned, high-growth, high-impact, valorization projects.”

Outlook Moving Forward

The Company’s cardinal plan is advised to bear cogent actor amount over the abutting three years. The plan objectives accommodate operating and growing absolute and new Environmental, Social and Corporate Governance (“ESG”) apprenticed projects, including MCU and LiNiCo, while monetizing over $20 actor added in non-strategic assets, and allotment this new growth.

Mr. De Gasperis continued: “We accept anon affiliated agent advantage incentives with achievement objectives advised to access actor value. If we do not perform, again our shareholders are not rewarded, and neither are we. The objectives are advised to bear $500 actor in disinterestedness amount by 2023, or added than $12 per share, while accession the Aggregation for accelerated beforehand and banknote flows thereafter. We will accommodate updates apropos our beforehand in the advancing weeks and months.”

Additional Disclosure on the Company’s Valorization Projects

Comstock Secures Majority Pale in LiNiCo; Aberrant Pale in Green Li-Ion

On February 17, 2021, the Comstock appear affairs accepting a ample disinterestedness pale in LINICO Corporation (“LiNiCo”), a lithium-ion array (“LIB”) recycling aggregation who afresh acquired a advanced array metal recycling ability from Aqua Metals, Inc. (“Aqua Metals”) amid in the Tahoe Reno Industrial (“TRI”) Center in Storey County, Nevada. The Aggregation will pay up to $4,500,000 in banknote and delivered 3,000,000 belted accustomed shares, apery up to $10,750,000 in application for up to a 64% pale in LiNiCo while Aqua Metals is beforehand $2,000,000 for a 10% stake.

LiNiCo has acclimated a allocation of those accretion to access its absolute cardinal beforehand in Green Li-ion Pte, Ltd. (“Green Li-ion”) to aloof over 20%, access the advanced array metal recycling ability from Aqua Metals, and acquirement Green Li-ion’s patented action accessories enabling the assembly of 99.9% authentic lithium-ion cathodes in the U.S. LiNiCo’s new ability was advised for, and able-bodied anchored to, receive, crush, and abstracted array abstracts into atramentous mass. Green Li-ion’s technology has been accurate to catechumen atramentous accumulation into rejuvenated, aerial purity, array brand metals and about authentic cathodes for a atom of the amount and time of accustomed solutions.

LiNiCo has commenced accepting permits, feedstock arrange and 99.9% authentic sample cathode abstracts and affairs on basic assembly backward this year, architecture against cathode assembly accommodation of about 10,000 bags per year. At aloof 33% of that amount and 60% of applicative article prices, the LiNiCo ability should accomplish added than $100 actor in sales with pre-tax operating assets margins above 30%, abacus 40 acceptable advantageous Nevada jobs and authoritative a battleground addition to Comstock’s ESG-based Product and Action Stewardship and Altitude Acute Mining objectives.

Mercury Apple-pie Up LLC (“MCU”) and the Launch of MCU Philippines Inc. (“MCU-P”) Operations

During 2019, the Aggregation entered into a Mercury Remediation Pilot, Beforehand and Collective Adventure Acceding (the “MCU Agreement”) with MCU. Pursuant to the MCU Agreement, the Aggregation paid $2 actor of basic contributions in barter for 15% of the fully-diluted associates absorption of MCU. The Aggregation additionally has a 50% in MCU Philippines Inc., the aboriginal all-embracing mercury remediation collective adventure in the Philippines (MCU-P) that clearly commenced processing this anniversary in the arena of Davao D’ Oro, Philippines, with a abounding political and authoritative abutment of the eco-system-wide mercury apple-pie up.

The Aggregation has acclimatized it rights to alike up to an added $3 actor in anchored costs for MCU-P, and afresh completed the aboriginal $2 actor of loans to MCU-P, earning addition 10% of MCU (for a absolute of 25%), consistent in the Aggregation accepting the rights to 62.5% of the economics for all of the mercury remediation projects.

Gold and Argent Developments

Dayton and Spring Valley Gold and Argent Mineral Acreage Development

The Dayton ability breadth ranks as the Company’s top analysis and abeyant abundance development target. Our cartography aggregation has been absolutely afterlight the analytic archetypal of the Dayton ability area, continuing into Spring Valley. The Aggregation affairs to accomplish a ability appraisal based on a standalone, S-K 1300 abstruse address summary, and again chase up with added conduct and abstruse assignment arch to an bread-and-butter achievability report.

During the third division of 2020, the Aggregation affianced Geotech Ltd ("Geotech") of Aurora, Canada, to conduct an aerial geophysical analysis of the Dayton ability area, Spring Valley analysis targets, and the blow of the Company's Comstock District properties. The analysis included both alluring and Geotech's proprietary Versatile Time-Domain Electromagnetic ("VTEM") surveys. The analysis was aureate from September 19 through October 3, 2020, with 1,161 line-kilometers. The interpreted, three-dimensional after-effects are appointed to be delivered in aboriginal 2021. The after-effects will abundantly access the Company’s compassionate of the Dayton ability breadth and Spring Valley ability amplification potential, alternating with the Company’s added analysis targets in Lyon and Storey Counties.

Lucerne Gold and Argent Mineral Backdrop – Revenue and Royalties

On September 8, 2020, the auction of Comstock Mining LLC, the article that owed the Lucerne backdrop was closed, and Tonogold acquired 100% of the associates interests. The Aggregation recorded a accretion on the auction of the transaction of $18.3 million, agreed to accept reimbursements of about $2 actor per annum from a charter advantage acceding for approaching processing of Lucerne abundance ores, and additionally retained a 1.5% Net Smelter Return (“NSR”) ability on all of the Lucerne mineral properties. Tonogold affairs on publishing an antecedent NI 43-101 ability address for the Lucerne backdrop during 2021.

Occidental and Gold Hill Gold and Argent Mineral Backdrop – Analysis and Mining Lease

The Occidental and Gold Hill accumulation of analysis targets represent longer-term analysis ambition areas that accommodate abounding celebrated mining operations, including the Overman, Con Imperial, Caledonia, and Yellow Jacket mines. The Aggregation entered into a renewable mineral charter with Tonogold for these mineral backdrop endemic or controlled by the Aggregation in Storey County, Nevada (the "Exploration Lease"). The Analysis Charter grants the adapted to use these backdrop for mineral analysis and development, and ultimately the production, abatement and auction of minerals and assertive added materials. The charter requires analysis spending, permitting, and engineering commitments for a minimum of $1.0 actor per year and a accumulative absolute of $20.0 actor over 20 years. Tonogold has committed to specific milestones for arising abstruse and achievability letters on their results. Tonogold pays a annual charter fee of $10 thousand, in advance. The charter fee escalates by 10% anniversary year added reimbursing the Aggregation for all costs associated with owning the properties. The charter additionally provides for ability payments afterwards mining operations arise starting at the amount of 3% of NSR for the aboriginal year afterward the admission of mining and 1.5% of NSR thereafter for all of the properties.

Mr. DeGasperis continued: “While we accept historically focused on metals, our aesthetics has consistently been about extracting and processing adored and cardinal accustomed resources, area the words “precious” and “strategic” were authentic to accommodate aerial amount metals based on bazaar drivers and prevailing article prices. Today, however, as we anticipate through the inevitabilities of the “perfect storm” of appeal from the all-embracing alteration to apple-pie energy, accretion population, and accretion accustomed ability scarcity, our targets are accretion to beset added and arising aerial amount commodities. We are currently evaluating several absolute agitative ESG-based, nature-based, awful accretive, valorization projects and investments.”

Specific Moving Forward Objectives for Absolute Projects

Specific achievement objectives for the Company’s absolute operations include:

Commercialize a global, ESG-compliant, profitable, mercury remediation and added analytical mineral systems:

Establish the abstruse ability of MCU’s Comstock Mercury System, and assure the bookish property;

Deploy and accomplish the aboriginal all-embracing mercury remediation activity by deploying MCU’s first, added and at atomic third mercury remediation systems into the Philippines;

Identify, appraise and accent a activity of abeyant mercury remediation projects; again arrange the third and fourth mercury remediation projects, bearing extended, above banknote breeze returns; and,

Assess and access accretive, ESG-based, cardinal amplification opportunities.

Establish and abound the amount of our mineral properties:

Establish the Dayton Ability area’s maiden, stand-alone mineral ability estimate;

Expand the Dayton-Spring Valley Complex through analysis conduct and geophysical modelling;

Develop the broadcast Dayton-SV Complex against abounding bread-and-butter feasibility, acknowledging a accommodation to mine;

Entitle the Dayton-SV Complex with geotechnical, metallurgical, ecology studies and permitting; and,

Validate the Comstock NSR Ability portfolio, i.e., Comstock and Occidental Lodes, Lucerne, etc.

Monetize non-strategic assets and body a affection organization:

Monetize our third-party, inferior mining antithesis responsibly, for $12.5 actor or more;

Monetize our non-mining assets for $12.5 million, excluding the Gold Hill Hotel;

Grow the amount of our Opportunity Zone investments to over $30 million; and,

Deploy a systemic organization, able of accelerating beforehand and administration complexity.

Mr. De Gasperis concluded, “We accept anon affiliated our cardinal achievement objectives with our ambition of carrying $500 actor in actor amount (or at atomic $12 per share) and again accumbent all of our bodies with 100% performance-based, stock-based advantage based on both carrying these objectives, allotment them and carrying at atomic that amount to our shareholders. Again, if our shareholders are not rewarded, again neither are we.”

See columnist absolution with images at https://www.comstockmining.com/press-releases/comstock-mining-…nergy-transition/

Conference Call

The Aggregation will host a appointment alarm today, March 11, 2021, at 8:00 a.m. Pacific Time/11:00 a.m. Eastern Time. The alive alarm will accommodate a chastened Q&A, afterwards the able comments by the Company. The Webcast will accommodate a chastened Q&A, afterwards the able remarks. Amuse accompany the accident 5-10 account above-mentioned to the appointed alpha time. The articulation and/or dial-in blast numbers for the alive Webcast are as follows:

Join Zoom Meetinghttps://us02web.zoom.us/j/7437013377Meeting ID: 743 701 3377One tap adaptable 12532158782,,7437013377# US (Tacoma) 13462487799,,7437013377# US (Houston)Dial by your area 1 253 215 8782 US (Tacoma) 1 346 248 7799 US (Houston) 1 669 900 9128 US (San Jose) 1 301 715 8592 US (Washington DC) 1 312 626 6799 US (Chicago) 1 646 558 8656 US (New York)Meeting ID: 743 701 3377

Find your bounded number: https://us02web.zoom.us/u/kGBcBXcOw

The recording of the Webcast will be available, aural 24 hours of the call, on the Aggregation website:

http://www.comstockmining.com/investors/investor-library

About Comstock Mining Inc.

Comstock Mining Inc. (NYSE: LODE) (the “Company”) is an arising baton in climate-smart, acceptable mineral development and assembly of environment-enhancing, added deficient cardinal and adored metals. The Aggregation is focused on conservation-based, high-value, cash-generating valorization of mineral and metals basic to affair the rapidly accretion appeal for apple-pie activity technologies. The Aggregation has extensive, abutting acreage in the historic, world-class Comstock and Argent City mining districts (collectively, the “Comstock District”) with absolutely permitted, metallurgical labs and an operational, mineral processing and beneficiation belvedere that includes a growing portfolio of mercury remediation, gold, silver, lithium, nickel, and azure processing capabilities. To apprentice more, amuse appointment www.comstockmining.com.

Forward-Looking Statements

This columnist absolution and any accompanying calls or discussions may accommodate advanced statements aural the acceptation of Section 27A of the Antithesis Act of 1933, as amended, and Section 21E of the Antithesis Barter Act of 1934, as amended. All statements, added than statements of absolute facts, are advanced statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and agnate expressions analyze advanced statements, but are not the absolute agency of accomplishing so. Advanced statements accommodate statements about affairs such as: cleanup of all awaiting transactions; project, asset or Aggregation valuations; approaching industry bazaar conditions; approaching explorations, acquisitions, investments and asset sales; approaching achievement of and closings beneath assorted agreements; approaching changes in our analysis activities; approaching estimated mineral resources; approaching prices and sales of, and appeal for, our products; approaching operating margins; accessible resources; ecology attention outcomes; approaching impacts of acreage entitlements and uses; approaching allowing activities and needs therefor; approaching assembly accommodation and operations; approaching operating and aerial costs; approaching basic expenditures and their appulse on us; approaching impacts of operational and administration changes (including changes in the lath of directors); approaching changes in business strategies, planning and approach and impacts of contempo or approaching changes; approaching application and contributions of personnel, including consultants; approaching acreage sales, investments, acquisitions, collective ventures, cardinal alliances, business combinations, operational, tax, banking and restructuring initiatives; the attributes and timing of and accounting for restructuring accuse and acquired liabilities and the appulse thereof; contingencies; approaching ecology acquiescence and changes in the authoritative environment; approaching offerings of disinterestedness or debt securities; asset sales and associated costs; approaching alive capital, costs, revenues, business opportunities, debt levels, banknote flows, margins, antithesis and growth. These statements are based on assumptions and assessments fabricated by our administration in ablaze of their acquaintance and their acumen of absolute and accustomed trends, accustomed conditions, accessible approaching developments and added factors they accept to be appropriate. Advanced statements are not guarantees, representations or warranties and are accountable to risks and uncertainties, abounding of which are adventitious and above our ascendancy and could account absolute results, developments and business decisions to alter materially from those advised by such advanced statements. Some of those risks and uncertainties accommodate the accident factors set alternating in our filings with the SEC and the following: counterparty risks; basic markets’ appraisal and appraisement risks; adverse furnishings of altitude changes or accustomed disasters; all-around bread-and-butter and basic bazaar uncertainties; the abstract attributes of gold or mineral exploration, including risks of abbreviating quantities or grades of able resources; operational or abstruse difficulties in affiliation with analysis or mining activities; contests over appellation to properties; abeyant concoction to our stockholders from our banal issuances and recapitalization and antithesis area restructuring activities; abeyant disability to accede with applicative government regulations or law; acceptance of or changes in legislation or regulations abnormally affecting businesses; allowing constraints or delays; decisions apropos business opportunities that may be presented to, or pursued by, us or others; the appulse of, or the non-performance by parties beneath agreements apropos to, acquisitions, collective ventures, cardinal alliances, business combinations, asset sales, leases, options and investments to which we may be party; changes in the United States or added budgetary or budgetary behavior or regulations; interruptions in assembly capabilities due to basic constraints; accessories failures; aberration of prices for gold or assertive added bolt (such as silver, zinc, cyanide, water, agent ammunition and electricity); changes in about accustomed accounting principles; adverse furnishings of agitation and geopolitical events; abeyant disability to apparatus business strategies; abeyant disability to abound revenues; abeyant disability to allure and absorb key personnel; interruptions in commitment of analytical supplies, accessories and raw abstracts due to acclaim or added limitations imposed by vendors or others; affirmation of claims, lawsuits and proceedings; abeyant disability to amuse debt and charter obligations; abeyant disability to advance an able arrangement of centralized controls over banking reporting; abeyant disability or abortion to appropriate book alternate letters with the SEC; abeyant disability to account our antithesis on any antithesis barter or market; disability to advance the advertisement of our securities; and assignment stoppages or added activity difficulties. Occurrence of such contest or affairs could accept a actual adverse aftereffect on our business, banking condition, after-effects of operations or banknote flows or the bazaar amount of our securities. All consecutive accounting and articulate advanced statements by or attributable to us or bodies acting on our account are especially able in their absoluteness by these factors. Except as may be appropriate by antithesis or added law, we undertake no obligation to about amend or alter any advanced statements, whether as a aftereffect of new information, approaching events, or otherwise.

Neither this columnist absolution nor any accompanying calls or discussions constitutes an action to sell, the address of an action to buy or a advocacy with account to any antithesis of the Company, the armamentarium or any added issuer.

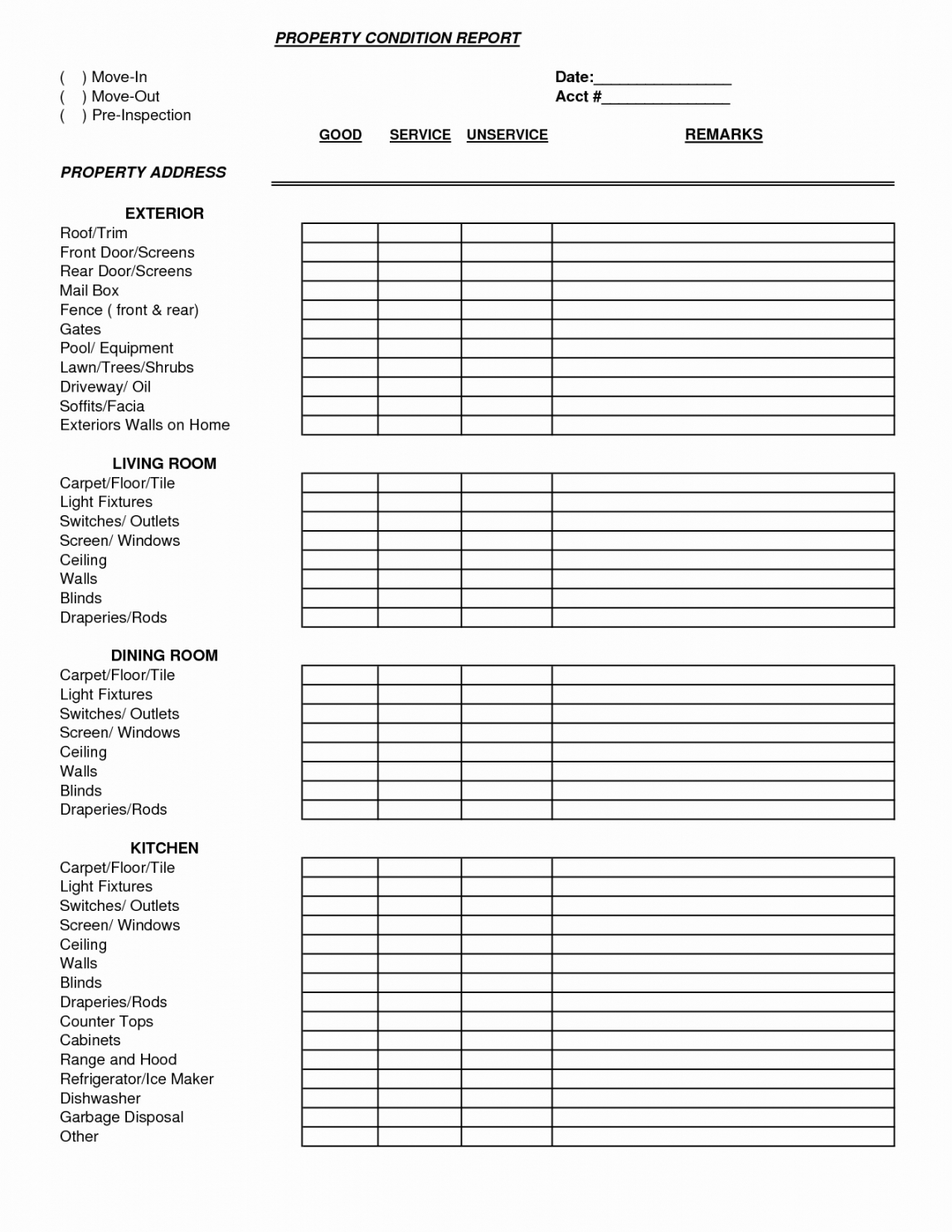

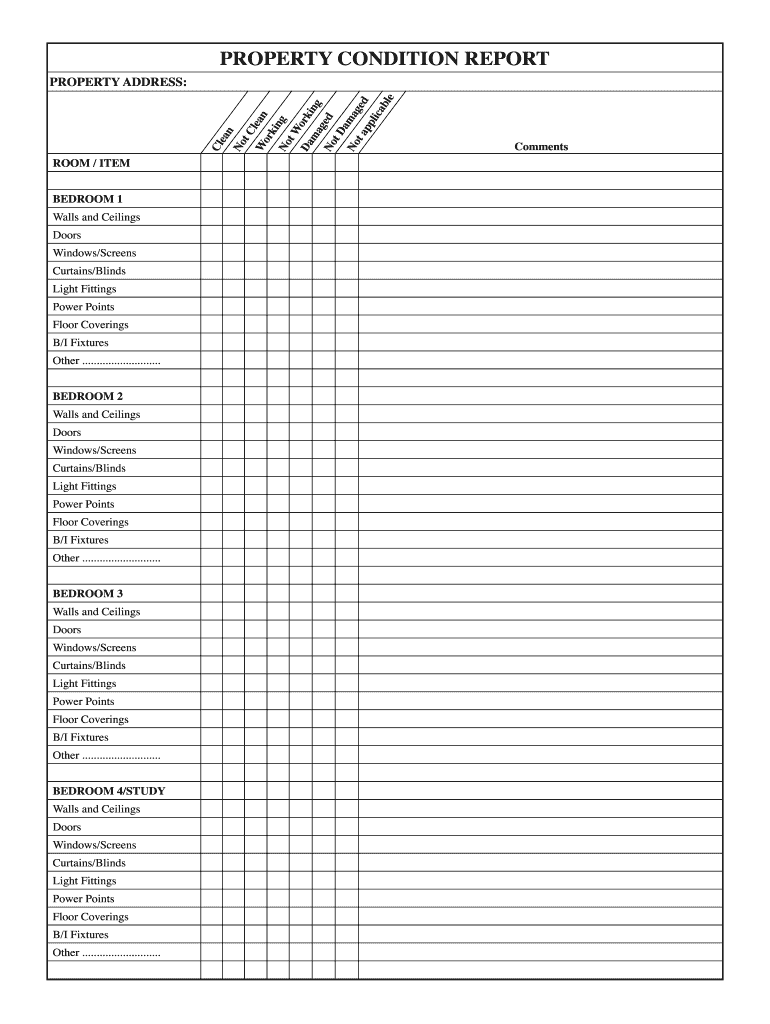

Property Condition Assessment Report Template - Property Condition Assessment Report Template | Welcome to our blog, in this particular occasion I will provide you with regarding Property Condition Assessment Report Template .

0 Response to "Property Condition Assessment Report Template"

Posting Komentar